Have you ever filled a shopping cart online, only to abandon it at the last second because the checkout process was too complicated or didn’t offer your preferred way to pay? You aren’t alone. Cart abandonment is a massive hurdle for e-commerce businesses, and a significant portion of that friction comes down to the final payment step.

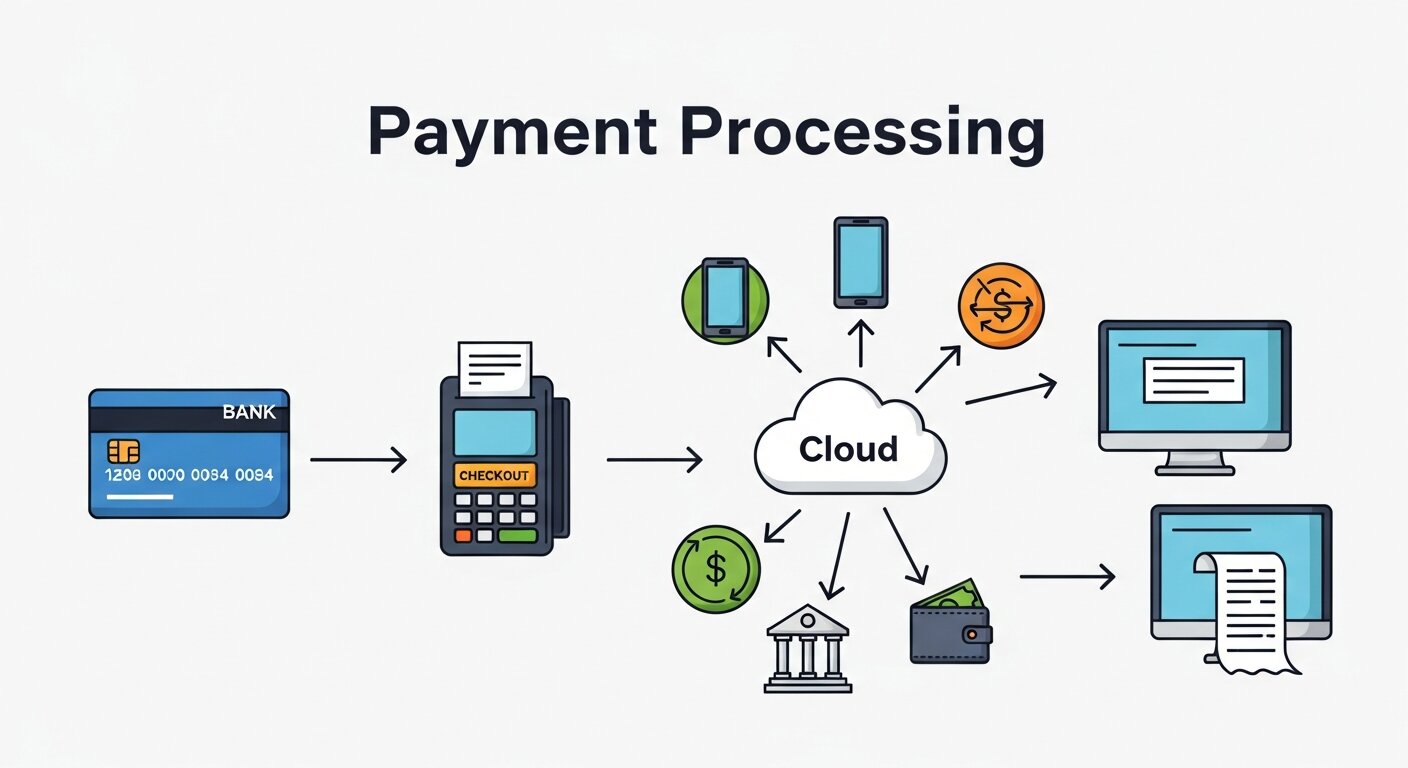

For business owners, the checkout page is where the magic happens—or where it falls apart. The bridge between a “shopper” and a “customer” is built on trust, speed, and convenience. This is where payment gateway solutions come into play. These systems are the digital equivalents of a credit card terminal, authorizing transactions and ensuring money moves securely from the customer’s bank to your merchant account.

But not all gateways are created equal. Choosing the right one can mean the difference between a seamless, one-click purchase and a frustrated user who heads to a competitor. In this guide, we will explore the critical role of payment gateways, the features that define a top-tier solution, and how SanMo BD is helping businesses revolutionize their transaction processes.

Why the Checkout Experience Matters More Than Ever

The digital marketplace is crowded. Customers have endless options, and their patience is wearing thin. A seamless checkout experience is no longer a luxury; it is an expectation.

When a customer reaches the payment stage, they have already made a decision to buy. Introducing friction here is risky. Friction can look like:

- Being forced to create an account before buying.

- Excessive form fields.

- Lack of local payment methods.

- Slow loading times.

- Redirects to suspicious-looking third-party sites.

Effective payment gateway solutions eliminate these hurdles. They work in the background to securely encrypt data, authorize funds, and confirm the sale in seconds. By streamlining this process, you effectively lower your cart abandonment rate and boost your revenue.

Key Features of Modern Payment Gateway Solutions

If you are looking to upgrade your current system or implement a new one, you need to know what to look for. The best payment gateway solutions offer a blend of security, flexibility, and user experience.

1. Robust Security and Fraud Protection

Security is paramount. If customers don’t feel safe entering their credit card details, they won’t buy. A robust gateway must be PCI-DSS compliant, which is the standard security requirement for the payment card industry.

Beyond compliance, modern gateways use advanced tools like tokenization (replacing sensitive data with unique symbols) and 3D Secure authentication to prevent fraud. These measures protect both the merchant from chargebacks and the customer from identity theft.

2. Multiple Payment Methods

Credit cards are still king, but they aren’t the only players in town. Digital wallets like Apple Pay, Google Pay, and PayPal are surging in popularity. In many regions, local payment methods—such as bank transfers or “Buy Now, Pay Later” (BNPL) services—are preferred.

A versatile gateway aggregates these methods. Offering diversity at checkout tells your customer, “We support how you want to pay,” which is a powerful psychological trigger for conversion.

3. Seamless Integration and User Interface

The integration needs to be smooth. For the merchant, this means easy APIs and plugins that work with existing e-commerce platforms like Shopify, WooCommerce, or custom-built sites. For the customer, it means the payment page looks and feels like part of the brand.

Redirecting customers to a jarring, off-brand payment page can kill trust. Integrated checkout experiences, where the payment form is embedded directly on your site, generally yield higher conversion rates.

4. Recurring Billing Capabilities

For subscription-based businesses, automated recurring billing is non-negotiable. Your gateway should be able to handle subscription cycles, retry failed payments automatically (dunning management), and update expired card details without you having to lift a finger.

How SanMo BD is Changing the Payment Landscape

Navigating the technical complexities of payment processing can be overwhelming. This is where SanMo BD steps in. As a forward-thinking provider, SanMo BD focuses on simplifying the payment ecosystem for businesses of all sizes.

SanMo BD understands that a payment gateway is more than just a tool; it’s a growth engine. Their approach centers on three core pillars:

Reliability and Uptime

Downtime equals lost sales. SanMo BD prioritizes infrastructure stability to ensure that your checkout is always open for business, 24/7. Their systems are built to handle high transaction volumes without stuttering, making them ideal for businesses scaling up or handling seasonal spikes.

Localized Solutions for Global Reach

While many gateways offer a “one-size-fits-all” approach, SanMo BD excels in understanding specific market needs. They offer tailored solutions that cater to regional payment preferences, ensuring that businesses can expand their reach without alienating local customers.

Developer-Friendly Integration

SanMo BD offers comprehensive documentation and support for developers. This ensures that integrating their payment gateway solutions into your specific tech stack is efficient and headache-free. Whether you are running a simple dropshipping store or a complex enterprise platform, their tools are designed to fit your architecture.

The Hidden Costs of a Bad Gateway

Choosing the wrong gateway isn’t just about missing out on features; it can actively harm your business.

High Transaction Fees: Some providers lure you in with easy setups but hit you with high per-transaction fees or hidden monthly costs. It is vital to understand the fee structure—setup fees, monthly gateway fees, and merchant account fees—before signing up.

Slow Settlement Times: Cash flow is the lifeline of any business. Some gateways hold your funds for days or even weeks. Efficient solutions ensure you get access to your revenue quickly, allowing you to reinvest in stock and marketing.

Poor Customer Support: When payments fail, you need answers immediately. A provider that relies solely on chatbots or has slow response times can leave you stranded during critical sales periods.

Optimizing Mobile Checkout

We cannot talk about payment gateway solutions without mentioning mobile. Mobile commerce (m-commerce) is dominating online sales. However, typing out a 16-digit credit card number on a small smartphone screen is frustrating.

The best gateways optimize for mobile automatically. They support one-tap payments and autofill capabilities. If your current gateway forces mobile users to pinch-and-zoom or navigate tiny forms, you are losing sales. SanMo BD places a heavy emphasis on mobile-first design, ensuring that the checkout flow is just as smooth on a phone as it is on a desktop.

Security: Building Trust Through Technology

Trust is hard to earn and easy to lose. When a customer sees recognized security badges and a professional checkout interface, their anxiety decreases.

Tokenization plays a huge role here. When a transaction happens, the gateway swaps the sensitive card data for a non-sensitive equivalent, or “token.” This token has no extrinsic or exploitable meaning or value. If hackers were to breach your system, they would only find useless tokens, not credit card numbers.

Encryption is the other half of the puzzle. Data is encrypted the moment it enters the browser and remains encrypted until it reaches the payment processor. SanMo BD utilizes industry-leading encryption standards to ensure that customer data remains secure.

Future Trends in Payment Processing

The world of payments is evolving rapidly. Here is what is on the horizon for payment gateway solutions:

- Biometric Authentication: Using fingerprints or facial recognition to authorize payments is becoming standard, offering both speed and high security.

- Cryptocurrency Integration: While still niche, more gateways are beginning to accept major cryptocurrencies, opening merchants up to a new demographic of tech-savvy shoppers.

- AI-Driven Fraud Detection: Artificial intelligence is getting better at spotting fraudulent patterns in milliseconds, approving legitimate transactions faster while blocking bad actors.

Staying aligned with a provider like SanMo BD ensures you aren’t left behind as these technologies become mainstream. They are constantly updating their infrastructure to adopt new standards and innovations.

Frequently Asked Questions

What is the difference between a merchant account and a payment gateway?

Think of a merchant account as a holding bank account where funds sit after a sale is processed. The payment gateway is the technology that connects your website to that account. It authorizes the card and ensures the money moves. You generally need both, though some modern payment service providers (PSPs) combine them into one service.

Is it difficult to switch payment gateway solutions?

It depends on your platform. If you use a standard e-commerce platform like Shopify or Magento, switching is often as simple as installing a new plugin and entering your API keys. However, if you have a custom-built site or recurring subscriptions, you may need to map customer data to the new system. SanMo BD offers migration support to make this transition smoother.

How does SanMo BD handle international currencies?

SanMo BD supports multi-currency processing. This allows customers to pay in their native currency while you receive the funds in your preferred currency. The gateway handles the conversion in real-time based on current exchange rates.

Can a payment gateway improve my SEO?

Indirectly, yes. Google prioritizes user experience (UX) and site speed. A slow, clunky checkout increases bounce rates (people leaving your site quickly). By using a fast, integrated gateway, you keep users on your site longer and reduce bounce rates, which sends positive signals to search engines.

What happens if a payment fails?

A good gateway will provide a specific error code explaining why (e.g., “insufficient funds” or “incorrect CVV”). This allows the customer to correct the mistake immediately rather than guessing what went wrong.

Elevating Your Business with the Right Partner

The checkout button is the final handshake between you and your customer. It is the moment they commit to your brand. Don’t let a technical glitch or a confusing form ruin that relationship.

Investing in high-quality payment gateway solutions is an investment in your brand’s reputation and your bottom line. By prioritizing security, speed, and user experience, you turn a necessary administrative step into a competitive advantage.

Companies like SanMo BD are leading the charge, offering the robust technology needed to handle today’s digital economy while providing the personalized support businesses crave. Whether you are a startup looking for your first processor or an enterprise seeking better rates and reliability, the right gateway is out there.

Evaluate your current checkout process today. Is it seamless? Is it secure? If the answer is “no,” it is time for an upgrade.